Down Payment: The figures on your advance payment can also affect your mortgage interest rate. Lenders may offer better rates to borrowers who placed down no less than 20% within the home's sticker price because the device reduces the lender's risk. If one makes a smaller put in, you may well be offered an increased rate and become required to spend private mortgage insurance (PMI), which protects the lender although you may default about the loan.

Condos tend to supply less space than singlefamily homes, which might be a drawback if you have an evergrowing family or require more storage. Customized for specific cultures of a regular condo senses more cramped, especially in older buildings. Additionally, as you are share walls with neighbors, privacy could be limited. Noise from adjacent units are often an issue, specially if soundproofing isn't optimal.

Factor out Closing Costs: Be familiar with the closing costs, which often mean many hundreds of dollars. These can incorporate loan origination fees, title insurance, appraisals, and various fees linked to the mortgage process.

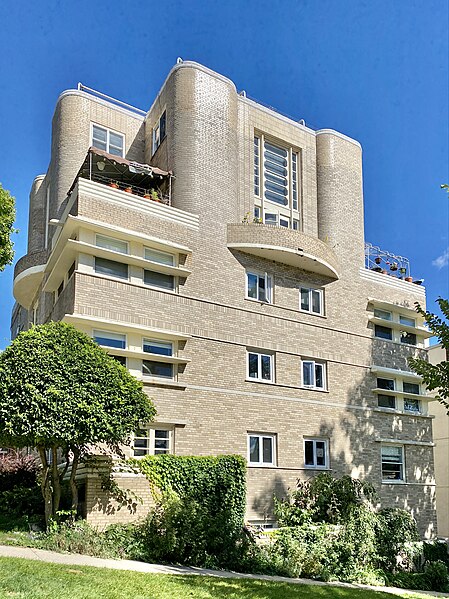

Luxury properties are more than solely places to live on; they're architectural masterpieces that come with unparalleled comfort, functionality, and beauty. By combining cutting-edge technology, premium materials, and innovative design, these homes redefine what this indicates to exist in style. Whether you're attracted to intricate interior details, stunning facades, or the seamless integration of light and space, these homes set the bar for modern luxury living. In the realm of luxury property, form and performance merge, creating spaces which might be as aesthetically stunning since they're livable.

Check Your Credit Score: Before trying to find a mortgage, review your credit score and score. An increased credit worthiness may help you secure a lower monthly interest, so make a move to increase your credit if necessary.

Shop Around for Lenders: Don't accept the most important mortgage offer you receive. Look with multiple lenders, including banks, credit unions, and on the internet lenders, to check rates and terms.

Consider Your Loan Term: Shorter loan terms (such as 15 years) usually are loaded with lower rates, although the every-month payments could be higher. Longer terms (such as 30 years) have lower every-month payments but may could prove expensive in the future because of higher interest.

Luxury properties today come with the most recent home based automation and smart technology, transforming the way we live. From voice-controlled systems to energy-efficient features, technology in luxury homes is built to provide comfort, security, and convenience, all while contributing to some more sustainable lifestyle.

If you'd like to take an added hands-off process of renting out your property, hiring a house management company might be a great solution. Property managers handle numerous tenant screening and lease agreements to rent collection and maintenance.

• Advantages of Property Management: Property management companies have example of handling day-to-day rental operations. He or she can also handle emergencies and address tenant issues promptly, reducing your workload. Additionally, they have an understanding of local laws and regulations, ensuring that you remain compliant.

• Cost Consideration: Property management companies typically charge a percentage of your monthly rental income (usually 8-12%), so you ought to factor this cost into your rental income calculations. However, the satisfaction and time savings could be worth the cost, specifically if you own multiple properties or use a busy schedule.

Market Conditions: Rates will be influenced by broader economic conditions, which include inflation, the Federal Reserve's monetary policy, and overall market demand. When the economy is strong, mortgage rates tend to elevate; once the economy is weak, rates may fall.

Choosing the ultimate property involves simply finding a property that appears great at first glance. By using your, location, the property's condition, and prospects for future growth, you'll wear a better position to produce a sound investment. Spend some time, research before you buy, and don't hesitate to seek professional advice to make sure that you're making a choice that aligns along with your financial goals and lifestyle needs. Housing is really a long-term investment, so guarantee that the house and property you end up picking is just one you'll pleased habitual to come.

Housing is mostly a tangible asset that offers diversification for your investment portfolio. If you rent then out a home, you add one other income-generating asset towards your portfolio, that could be especially valuable in the event you make use of stocks, bonds, or other financial instruments.

• Hedge Against Inflation: Real estate investment might be considered a quality hedge against inflation. When inflation rises, rents typically increase besides, allowing you to raise rents gradually in line with the market and gaze after your dollars flow.

• Asset Security: Unlike stocks or bonds, that can fluctuate with the forex market,

Real Estate Services estate investment may be a physical asset. Thus giving you that security, so if you manage the house and property well and ensure it's in demand.